Digital currency is reshaping how we think about money, payments, and financial systems. The advantages of digital currency extend far beyond just being “cool tech” – they’re solving real business problems right now.

We at Web3 Enabler see companies cutting costs, speeding up transactions, and reaching new markets through digital currency adoption.

From slashing transaction fees to banking the unbanked, digital currencies are proving their worth in the real world.

How Much Money Can Digital Currency Save Your Business

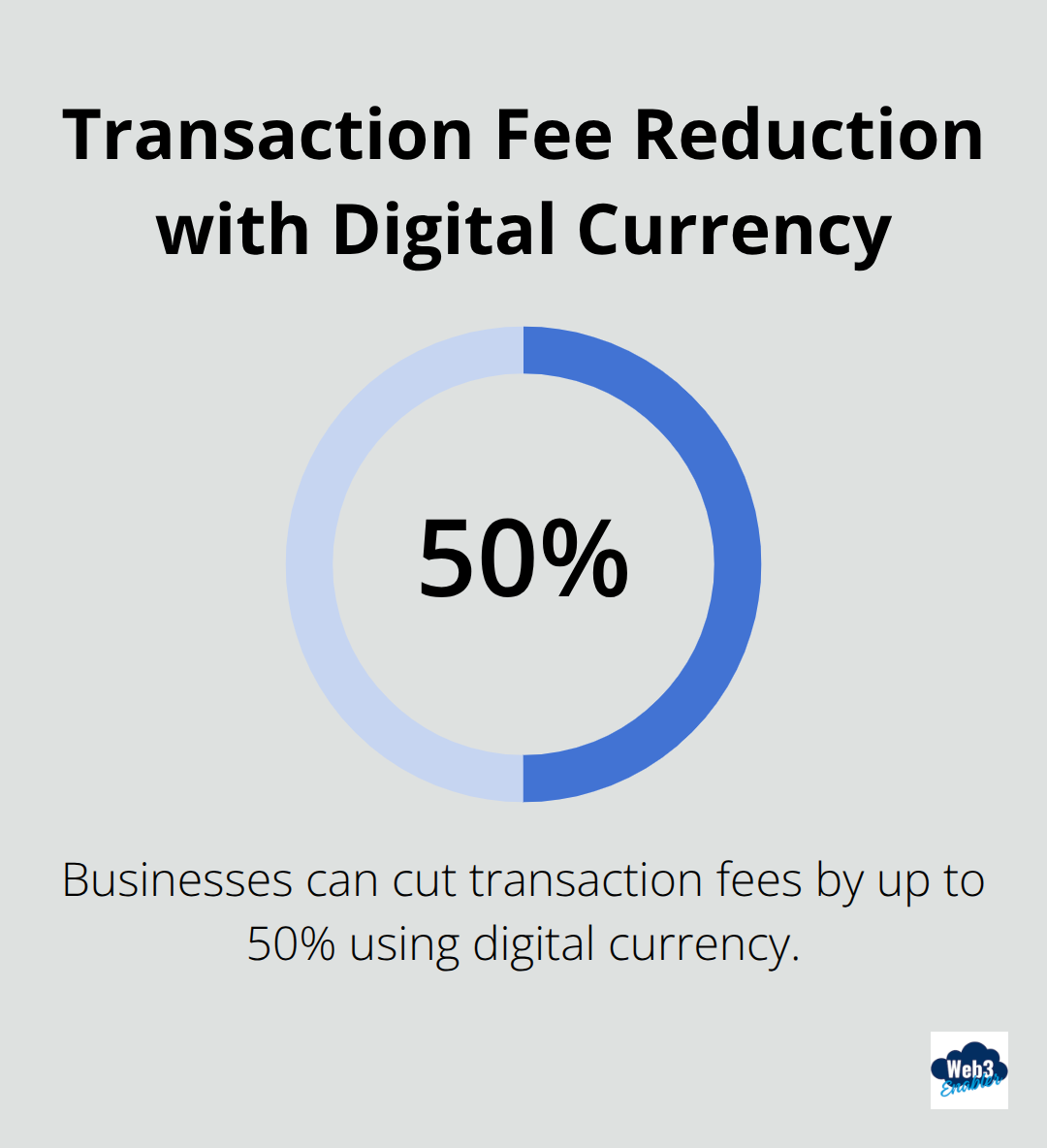

Traditional banking infrastructure costs businesses billions annually through transaction fees, processing delays, and operational overhead. Digital currency eliminates most of these expenses while it accelerates payment speeds dramatically. Blockchain technology reduces costs in global trade by up to $116 billion annually according to industry analysis, with businesses that cut transaction fees by up to 50% compared to conventional banking systems.

Transaction Costs Drop to Near Zero

Payment processors like Visa charge merchants 1.5% to 3.5% per transaction, plus fixed fees. Digital currency transactions typically cost under $0.01 for most networks, regardless of transaction size. A business that processes $1 million monthly in credit card payments pays roughly $25,000 in fees. The same volume in stablecoins costs less than $100. PayPal and Square have integrated Bitcoin payments specifically because the math works – lower fees mean higher profits.

Cross-Border Payments Happen in Minutes

International wire transfers take one to three days and cost $15 to $50 per transaction through traditional banks. Digital currencies process cross-border payments in minutes at a fraction of the cost. Companies that use stablecoins for international payments report 90% cost reductions and same-day settlement. The Lightning Network makes Bitcoin transactions even faster and cheaper, as it processes thousands of transactions per second. Major airlines and travel companies now accept Bitcoin precisely because international transactions become seamless.

Physical Banking Infrastructure Becomes Optional

Digital currencies operate 24/7 without bank branches, ATMs, or physical cash management. This eliminates armored car services, cash counts, and deposit runs (saving retail businesses thousands monthly on cash management services). The World Bank notes that 1.3 billion adults globally lack bank accounts, but digital currencies provide financial services without traditional banking infrastructure. This opens massive new markets for forward-thinking businesses.

Real-World Implementation Success

Major retailers like Home Depot and Whole Foods now accept Bitcoin, while Starbucks and Microsoft have embraced crypto payments. These companies report streamlined operations and expanded customer bases. Overstock positioned itself as a forward-thinking retailer in the digital economy through early Bitcoin adoption. The numbers speak for themselves – businesses that embrace digital currency gain competitive advantages that translate directly to their bottom line.

These financial benefits create the foundation for broader operational improvements that transform how businesses handle payments, security, and transparency.

How Digital Currency Transforms Business Operations

Digital currency transforms business operations through automated payment processes that eliminate manual intervention and human error. Traditional payment systems require multiple steps: authorization, clearing, settlement, and reconciliation. Digital currency payments execute instantly on blockchain networks, with automated systems that process conditional payments based on delivery confirmations or milestone completions. Companies that use stablecoins report faster payment times and reduction in administrative overhead. JPMorgan integrated blockchain technology specifically to reduce transaction costs and delays. The automation extends beyond payments – digital currencies enable programmable money that executes business logic automatically, which removes layers of manual verification and approval processes.

Fraud Prevention Through Blockchain Security

Blockchain technology provides immutable transaction records that make fraud detection easier and prevention stronger. Traditional payment fraud costs businesses billions annually according to industry reports, with chargebacks alone costing merchants globally. Digital currency transactions cannot be reversed once confirmed, which eliminates chargeback fraud entirely. The transparent nature of blockchain allows complete transaction traceability – every payment can be tracked from origin to destination. Digital currency transactions show low levels of illicit activity, which challenges misconceptions about digital currency security. Major financial institutions adopt blockchain precisely because cryptographic security makes counterfeiting nearly impossible (companies that switch to digital currency payments experience dramatic reductions in payment disputes and fraud-related losses).

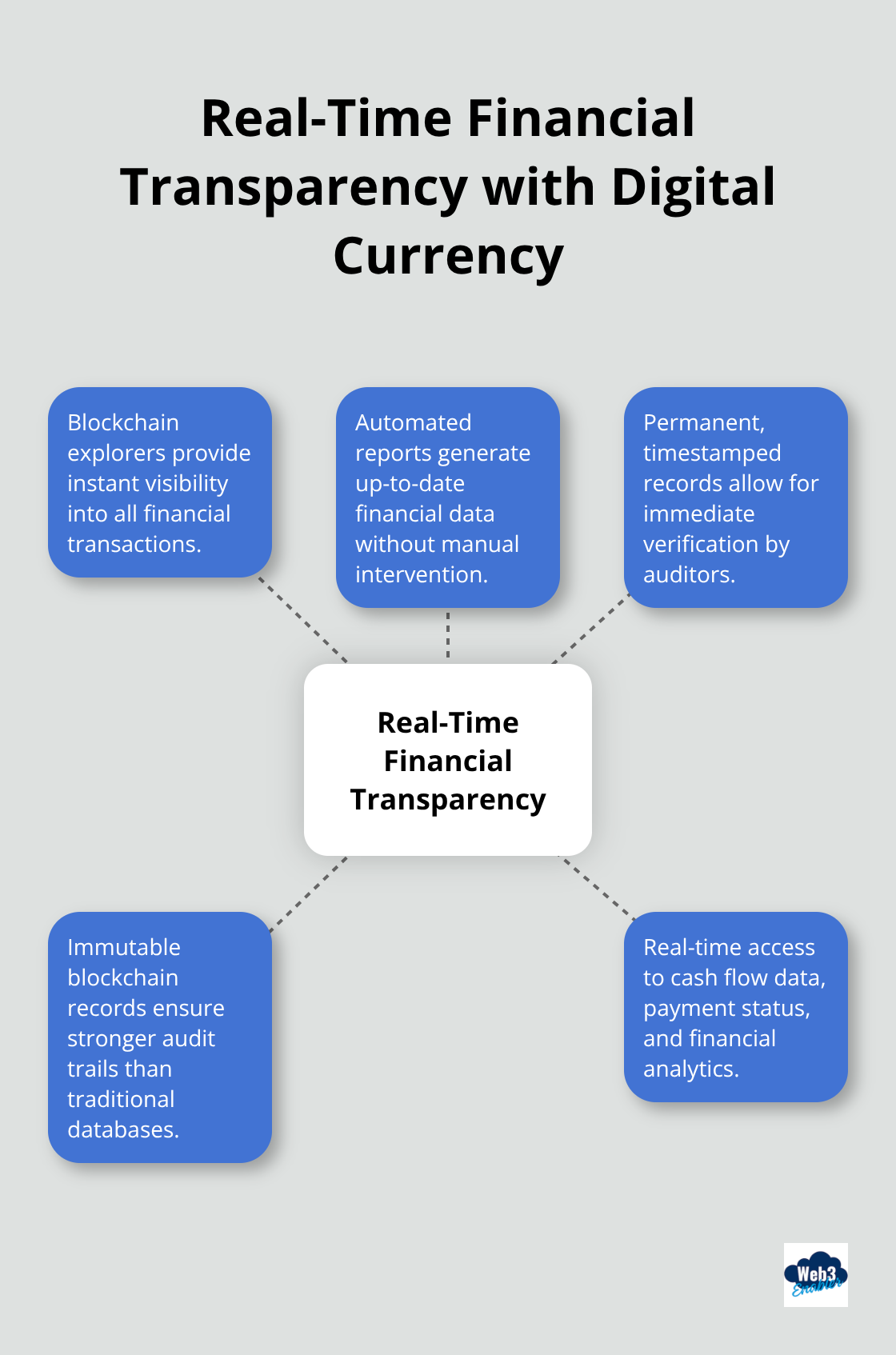

Real-Time Financial Transparency and Audit Capabilities

Digital currencies provide real-time visibility into all financial transactions through blockchain explorers and automated reports. Traditional accounting requires month-end reconciliations and manual audit trails. Blockchain transactions create permanent, timestamped records that auditors can verify instantly. This transparency reduces compliance costs for regulated industries, as demonstrated by financial institutions that implement blockchain-based audit systems. The immutable nature of blockchain records means financial data cannot be altered retroactively (providing stronger audit trails than traditional databases). Companies gain immediate access to cash flow data, payment status updates, and financial analytics that previously required days or weeks to compile.

These operational improvements create the foundation for global accessibility that opens new markets and serves previously underbanked populations worldwide.

Who Benefits Most from Digital Currency Access

Digital currency removes geographic and economic barriers that traditional banks create. The World Bank reports that digital currencies can provide financial services to unbanked populations worldwide, with regions like Venezuela and Argentina experiencing massive Bitcoin adoption due to economic instability. Companies that accept digital currency payments instantly access global markets without establishing local banking relationships or currency exchange partnerships. Major retailers like Travala and CheapAir demonstrate this by accepting Bitcoin for travel bookings worldwide, while platforms like Shopify enable merchants to reach cryptocurrency users across continents.

Digital Currency Never Sleeps or Takes Holidays

Traditional banks shut down evenings, weekends, and holidays, creating payment delays that cost businesses millions in cash flow problems. Digital currency networks process transactions continuously, enabling businesses to receive payments and send supplier payments at any time. International wire transfers that take three business days through banks complete in minutes with stablecoins like USDT and USDC which have processed trillions in transactions. Companies using digital currency for international trade report immediate settlement and elimination of weekend payment delays that previously disrupted supply chain financing.

Emerging Markets Lead the Digital Revolution

India ranks as the top country for cryptocurrency adoption according to recent Chainalysis Global Crypto Adoption Index reports, followed by the United States and Pakistan. The Asia-Pacific region shows significant year-over-year growth in crypto activity, with substantial increases in total transaction volume. Countries like Ukraine, Moldova, and Georgia lead adoption when adjusted for population size, demonstrating high usage relative to their economies. Latin America reported increased crypto adoption, highlighting surge in both retail and institutional participation. These markets represent massive opportunities for businesses that accept digital currency payments, as traditional banks often fail to serve these populations effectively.

Final Thoughts

The advantages of digital currency create measurable business value through reduced costs, faster payments, and global market access. Companies save up to 50% on transaction fees while they process international payments in minutes instead of days. Automated payment systems eliminate manual errors and fraud risks, while 24/7 availability removes bank hour restrictions that previously delayed business operations.

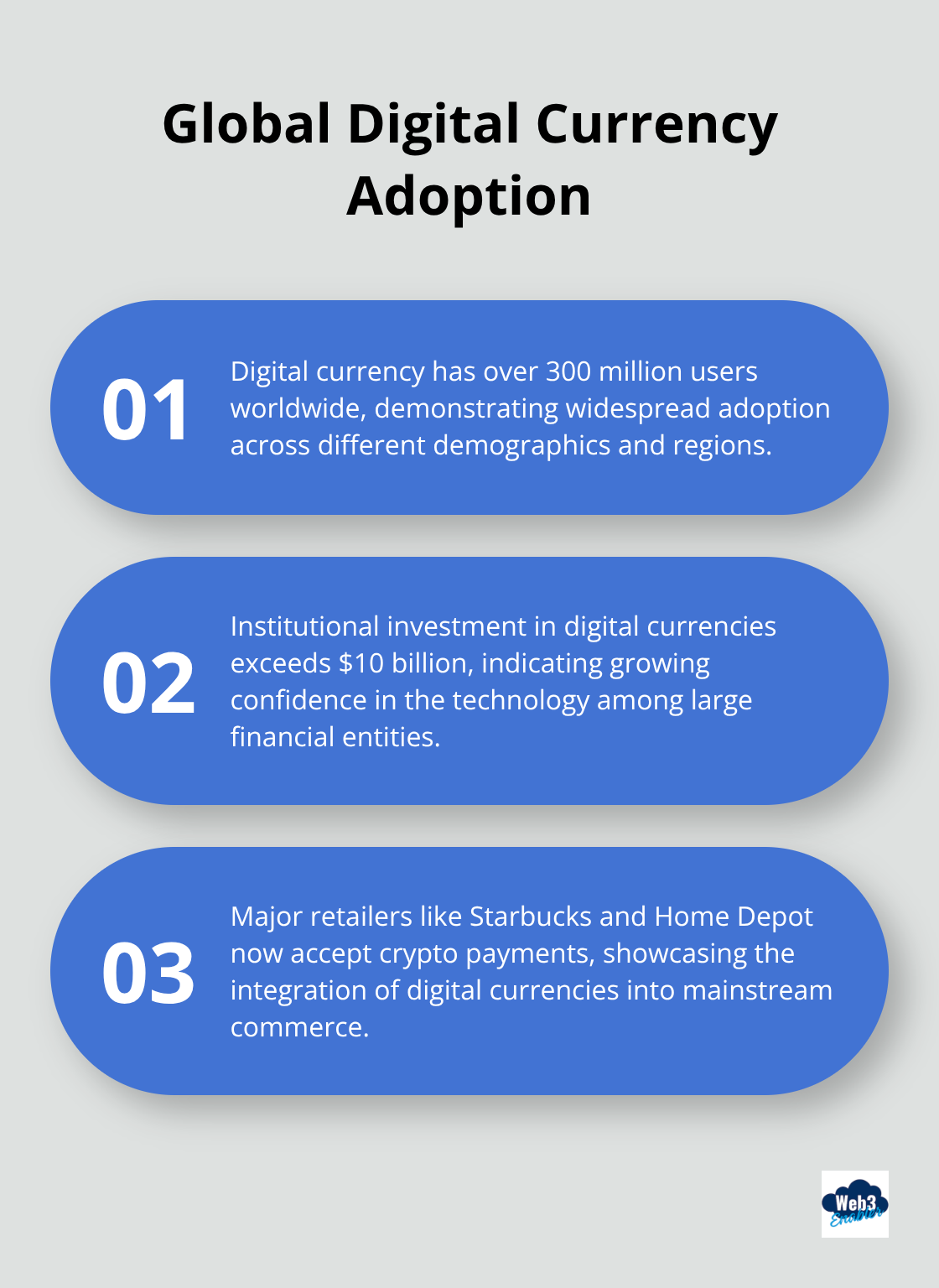

Digital currency adoption accelerates worldwide, with over 300 million users and institutional investment that exceeds $10 billion. Major retailers from Starbucks to Home Depot accept crypto payments, while regions like Asia-Pacific show 69% year-over-year growth in transaction volume. The technology has moved beyond speculation to become practical infrastructure for modern businesses (that need competitive advantages in global markets).

Companies ready to implement digital currency solutions need partners who understand both blockchain technology and existing business systems. We at Web3 Enabler provide Salesforce Native blockchain solutions that integrate seamlessly with corporate infrastructure. These solutions enable stablecoin payments and global transactions without disruption to current operations.