Accept USDT in Salesforce

- Home >

- Accept USDT in Salesforce

Enhancing Salesforce with USDT Integration: A Leap Forward in Cryptocurrency Payment

Seamless USDT Integration for Salesforce Users

Accept USDT in Salesforce with 100% Native Blockchain Payments. Salesforce platforms now offer seamless integration with USDT (Tether), one of the most dominant and trusted stablecoins in the crypto market. With its value securely pegged 1:1 to the US dollar, USDT offers unmatched price stability. This addresses one of the key challenges businesses face with crypto: volatility.

This strategic enhancement allows businesses using Salesforce to accept Tether confidently. It streamlines transactions while minimizing exposure to price fluctuations. With USDT holding a commanding global stablecoin market share of over 70%, the integration provides a significant edge. Indeed, it expands payment flexibility and customer reach.

Tether’s Market Dominance and Stability

Originating in Hong Kong and closely linked with the Bitfinex exchange, Tether has grown into the global leader in the stablecoin space. Businesses can now accept Tether in Salesforce using Web3 Enabler’s Blockchain Payments platform. This enables seamless off-ramps to USD through trusted exchanges.

Although USDT may be less commonly used within the United States compared to USDC, its overwhelming popularity across international markets makes it the go-to choice for global transactions. Therefore, for businesses looking to grow internationally, the decision to accept USDT opens doors to customers who already rely on this stable, liquid asset for day-to-day crypto activity.

Broadening Payment Horizons with USDT

Adding USDT to Salesforce’s payment capabilities doesn’t just provide another payment option. It also unlocks a powerful tool for expanding into new markets. Businesses that accept USDT in Salesforce immediately benefit from faster settlement times, reduced processing costs, and exposure. In addition, they gain access to an increasingly crypto-native customer base.

This integration supports a more diverse range of customer preferences, providing options beyond traditional credit cards and bank transfers. Customers who prefer to pay with stablecoins can now do so securely. This gives companies a competitive advantage in regions where blockchain adoption is high.

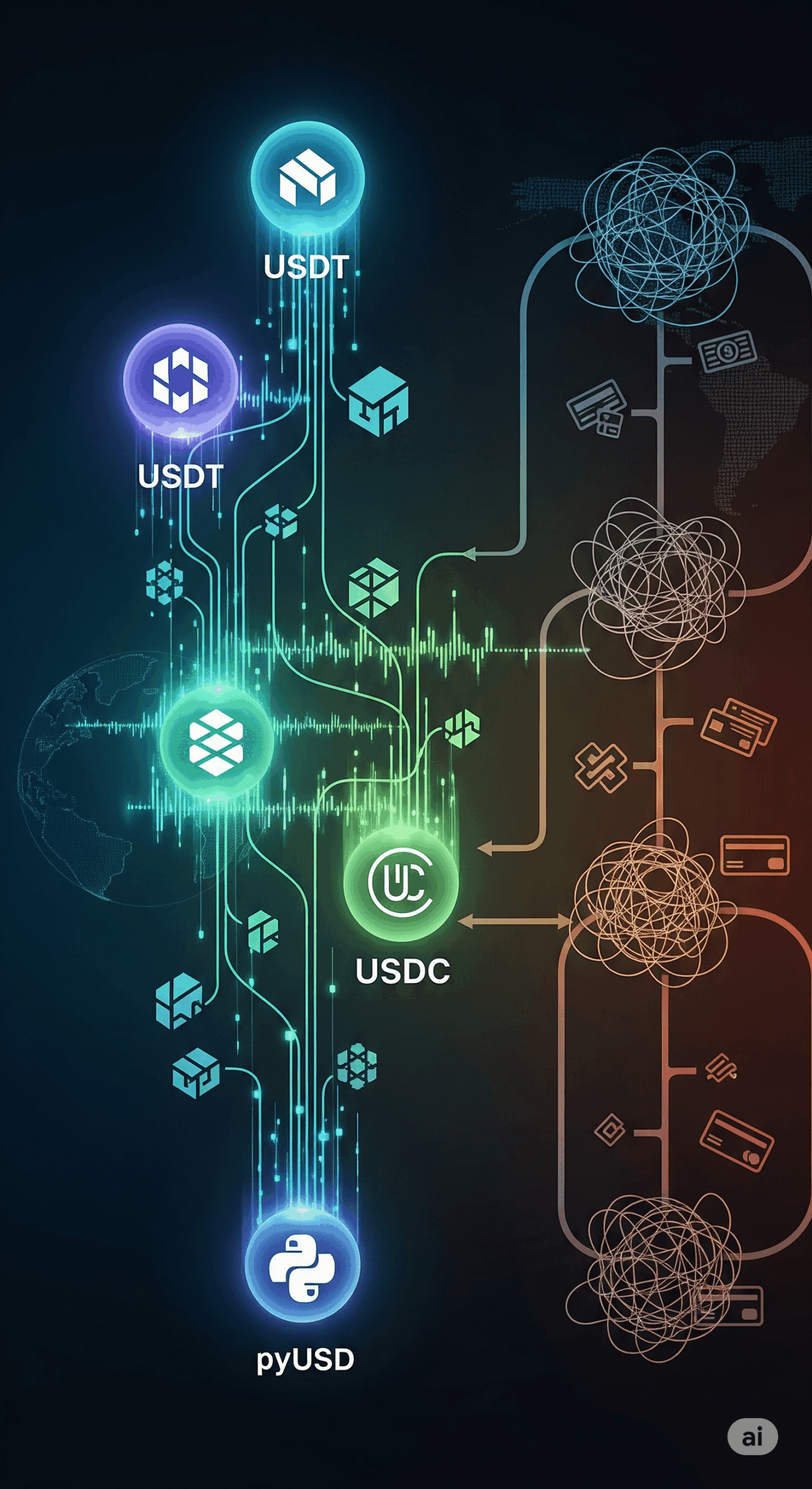

Different Dollar Based Stable Coins

There is a variety of options in the Stable Coin market. Therefore, astute companies will aim to accept as many of them as feasible. Globally, USDT is the dominant option. However, in the United states, Circle’s USDC is more popular. This is why Blockchain Payments supports both popular currencies. Starting with v2.2 and native support for XRP. Furthermore, we support the USD Currency on Ripple’s supported network. We have supported Paypal’s pyUSD on Ethereum since v1.4.

Web3 Enabler believes that companies should support as many payment options as they are comfortable. This increases their global reach. By working with credible exchanges, you should be able to off-ramp payments to your bank account on a regular basis with minimal fees. While blockchain transactions may seem unusual, they are faster and cheaper than existing systems. In particular, they outperform those based on the SWIFT system or bank wires. USDT’s heavy global presence makes its addition obvious for companies growing their global footprint.

Bridging Traditional Finance and Cryptocurrency with USDT

The ability to accept USDT in Salesforce is more than a technical upgrade. It represents a shift in how businesses approach payments. It bridges the gap between traditional finance and digital assets. This creates a stable, efficient system that caters to modern financial needs.

By offering stablecoin payment options like USDT, companies can future-proof their operations. They also meet the demands of a more global, tech-savvy customer base. Whether you’re selling SaaS subscriptions, professional services, or physical goods, adopting stablecoin payments helps reduce risk. It also improves settlement speed, and streamline compliance.

Integrating blockchain-based payments into Salesforce is a leap forward in business innovation. When businesses accept Tether and other stablecoins, they position themselves to meet the expectations of a new generation of customers and partners.

USDT’s global dominance, speed, and reliability make it an obvious choice for organizations seeking to modernize payment processing. With Web3 Enabler, the process of enabling Salesforce to accept USDT is seamless, secure, and scalable. This empowers businesses to lead in the new financial era.